Trade Financing

Improved Cash Flow

Working Capital Optimization

Mitigated Payment Risks

15

Years of Experience In finance

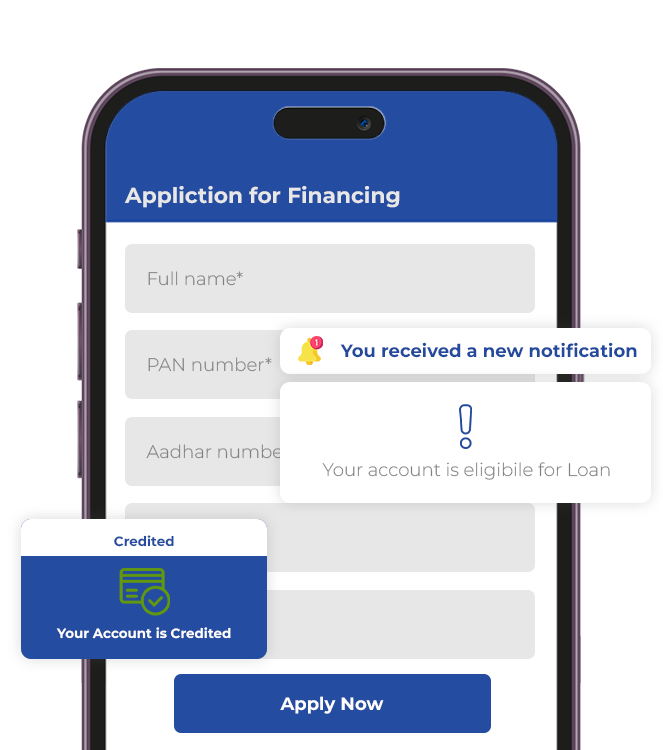

Steps to Apply for Trade Financing:

1

2

3

4

Frequently Asked Questions

Trade Financing refers to financial solutions that help businesses facilitate international and domestic trade transactions by providing funds to bridge the gap between purchasing goods and receiving payments

Trade financing options include letters of credit, trade guarantees, export/import financing, supply chain financing, and invoice financing. The availability of specific options may vary based on your business requirements.

The application process can vary depending on the complexity of your trade transactions and the required documentation. Our team will work closely with you to expedite the process and ensure a timely response.

Kredmint brings extensive experience in trade financing, a deep understanding of global trade dynamics, and a commitment to providing tailored solutions to meet your unique business needs. We prioritize transparency, reliability, and customer satisfaction.